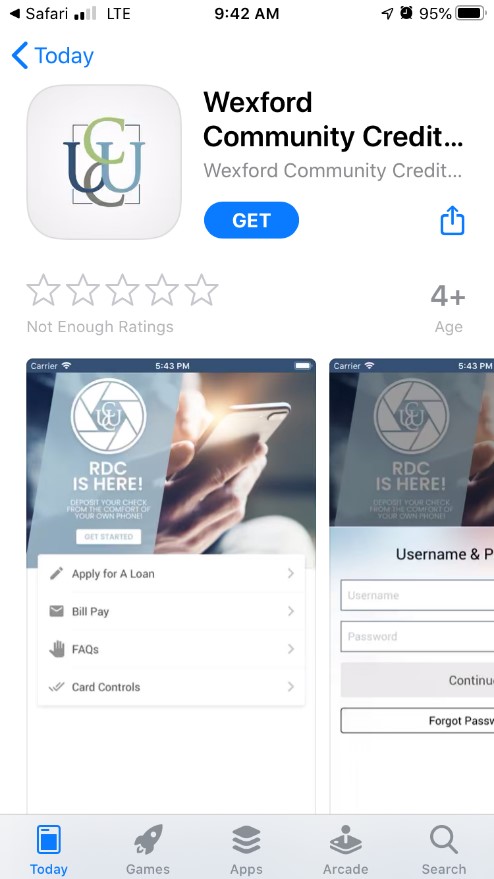

Mobile App

The WCCU mobile app gives you even more control over your finances!

With Wexford Community Credit Union’s app, you are afforded 24/7 access to your account from any location.

With Wexford Community Credit Union’s app, you are afforded 24/7 access to your account from any location.

- Check your balance

- Deposit a check

- Lock or unlock your debit card

- Transfer funds between your accounts or to another member

- See what has been deposited

- Find when a check or automatic payment has cleared

- Make transfers between your account

Register for RDC

Register for RDC

Your account must be at least 30 days old to qualify for this feature.

Registration is typically approved within one business day.

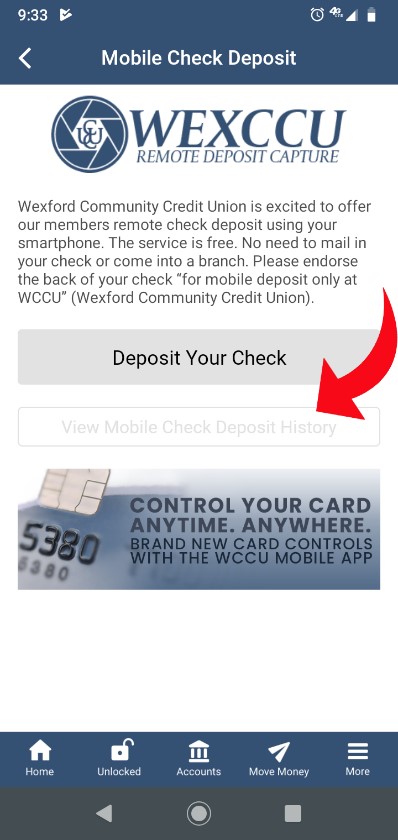

Deposit your Check

Once approved, you can click on the move money icon and then the Deposit Check icon (the camera).

You’ll get instructions with each step. Remember to endorse the check as requested! READ those tips.

- Checks deposited before 4 pm will be deposited between 4 pm and 4:30 pm the same day.

- Max deposits per day: 3

- Max amount per deposit: $2000

For our business account members:

- Max deposits per day: 10

- Max amount per item: $10,000

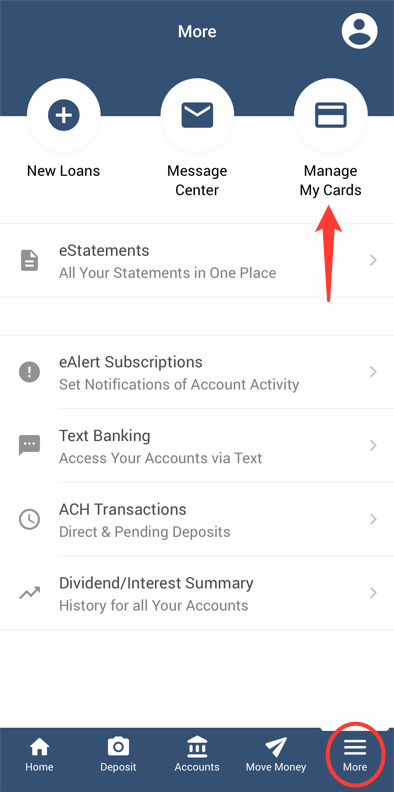

Freeze your debit card.

Freeze your debit card.

If you can’t find your card, but not sure it’s lost yet, you can freeze your debit card.

If you find it, unfreeze it!

Close your debit card.

If you’ve lost your card, or find unauthorized purchases on your card, you can shut it down.

Let us know that you’ll need a new card when you call to initiate a dispute.

You can add your debit card and Visa credit card to your phone's mobile wallet. Using your mobile wallet adds security to your transactions because your card is encrypted (tokenized). If a breech occurs, the token is exposed and not the members card information.

We participate in Apple, Google, and Samsung wallets. Please call Card Services if you would like assistance adding your card to your mobile wallet.

Card Suite Lite

- Card Freeze/Unfreeze Capability: Members can temporarily disable and re-enable their VISA cards as needed.

- Expanded Location and Transaction Controls: FIS has introduced advanced controls, including:

- Merchant and regional transaction blocks.

- The ability to block transactions occurring more than 8 miles from the member’s current location.

- Extended Transaction History: Members will have access to 60 days of transaction history, up from the current 30 days.

- Real-Time Transaction Alerts: Immediate notifications for card activity will be available.

EZ Card

- Access statements and transaction information.

- Access ScoreCard Reward points.

- Analyze your spending.

- Provides access to pay VISA bills with other financial institution payment information.

Score Card Rewards

- Earn reward points! 1 point = 1 dollar spent unless a bonus point promotion is occurring.

- Use your VISA credit card at participating merchants during bonus point promotions to earn 2 points per 1 dollar spent.

- Points can be applied for discounts on travel, flights, gas, and more.

- Redeem points for items such as smart watches, air flyers, tumblers, and more.

- Daily entries for monthly sweepstakes starting as low as 50 points per entry!